Will New Paramount succeed under the direction of new head David Ellison? We won’t know for a few years yet. The merger between Skydance (where Ellison is CEO) and Paramount is not expected to close until September 2025. Before he can build an enduring entertainment brand, Ellison first must focus on streamlining legacy Paramount’s unprofitable operations.

But if he plays his cards right, David Ellison could become a New Hollywood mogul. He has a track record for producing crowd-pleasing entertainment, including Top Gun: Maverick, one of the biggest-selling movies of all time. His personal brand looms large, but he has a lot of work to do to build New Paramount, the name of the new entity resulting from the merger.

A Murky Announcement

The July 7 announcement and July 8 investor briefing about the Skydance/Paramount merger was about as exciting as a financial auditor’s report. The newly formed management team (which counts three CEOs on Paramount’s side) discussed the many ways that New Paramount will become a New Hollywood player while shedding the Old Hollywood costs and business practices that have cost Paramount a fortune.

In doing so, the team adopted a tech bro swagger and tossed jargon-like darts at equity analysts. There was much discussion about making New Paramount a technology/media company that will “optimize ad-tech to improve buy-side transparency and audience reach/measurement,” which means monetizing audiences more effectively with advertising.

They bragged about “the ultimate bundle that’s coming,” their desire to improve Paramount+’s algorithm, and their mandate to “unify cloud providers for all distribution services.” In other words, they’re going to make their multiple streaming services (including Paramount+ and Pluto TV) efficient and profitable through advertising.

Since New Paramount must appease investors, coming out of the gate in a flurry of financial jargon was understandable if boring. In all the corporate messaging, though, it was difficult to see how New Paramount would inspire subscribers. This is likely because New Paramount is first trying to get its operations under control before creating more compelling entertainment.

Role of Technology and Advertising

The company’s execs made it clear that they understand they must strengthen New Paramount’s online platforms, including Paramount+, as Job One. For instance, New Paramount plans to improve its streaming algorithms to offer personalized content recommendations. In other words, Paramount+ needs to play catch-up with Netflix, whose algorithm suggests content based on viewing habits, a major factor in its success.

New Paramount will also streamline its online offerings by unifying cloud providers to reduce operational costs and improve reliability. Here, New Paramount is trying to emulate Amazon Prime Video’s smooth experience as a benchmark.

However, the real challenge will be how effectively New Paramount can integrate these technologies without alienating its current subscriber base. The success of this strategy will largely depend on the execution and whether the improvements genuinely make the user experience better.

It’s also unclear how New Paramount will build its connected TV advertising business. Paramount+ already offers an advertising-supported tier, Paramount+ Essential. Paramount is trying to push more subscribers to its ad tier by raising prices for its ad-free option while keeping prices stable for Paramount+ Essential.

As noted, the management team vowed to improve its ad-tech business through better buy-side transparency and audience reach/measurement. Better transparency is attractive to advertisers looking to maximize their return on investment.

Competitors such as Amazon, Disney+, and Netflix have a leg up on Paramount+ by refining their own ad models to create more relevant and targeted experiences. But leveling up with advertising will certainly help staunch the cash bleed that Paramount is experiencing.

The New Paramount Near-Term Entertainment Strategy

Paramount+ is central to New Paramount’s strategy. Up to the merger, Paramount’s strategy for Paramount+ has looked like this:

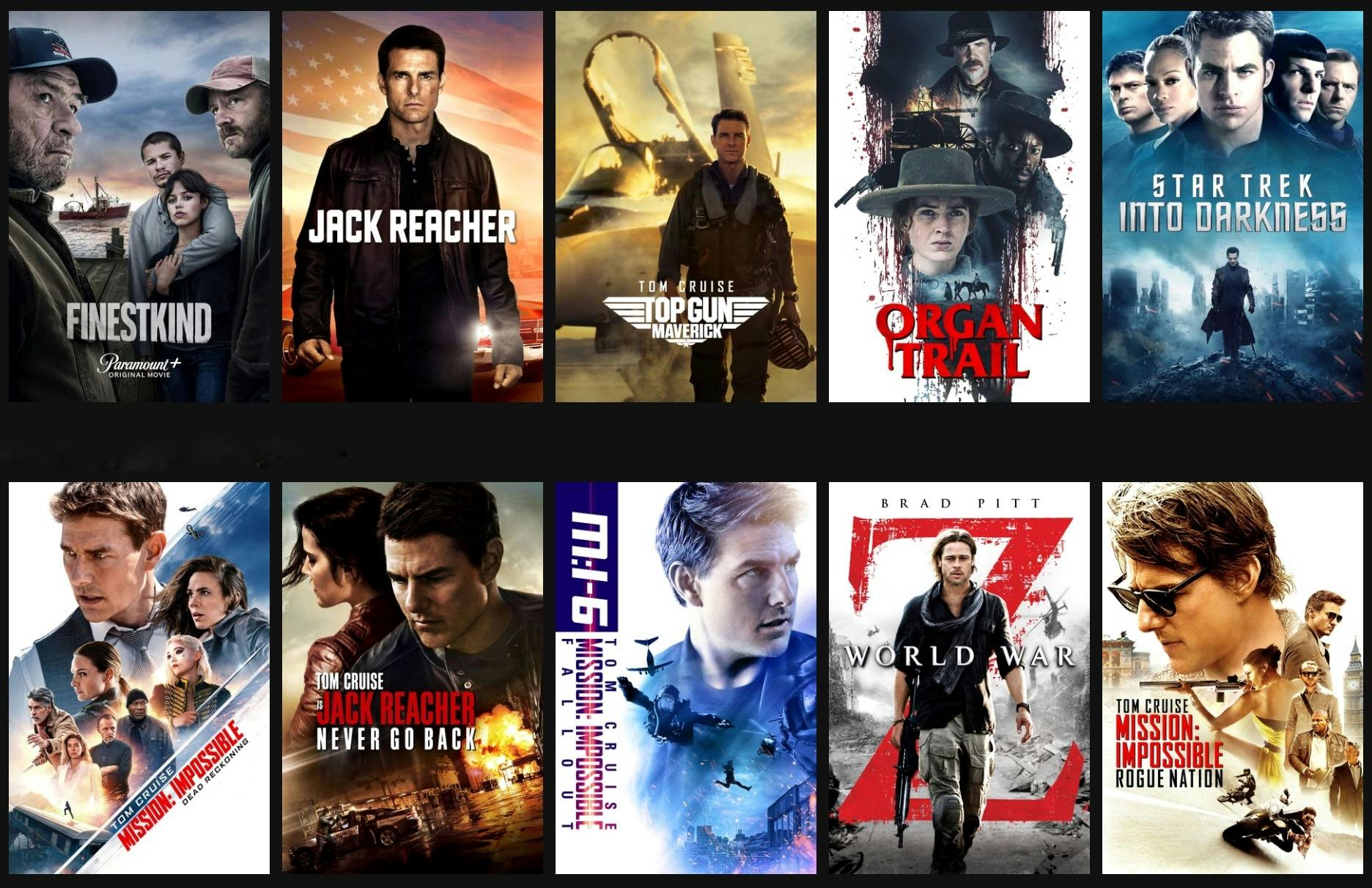

- Original content: leaning into franchises like Star Trek and Mission: Impossible to create exclusive series and movies. For instance, the Star Trek universe on Paramount+ has expanded with new series like Star Trek: Discovery and Star Trek: Picard, drawing in a dedicated fanbase.

- Exclusive releases: offering exclusive releases that cannot be found on other platforms. HBO Max has successfully used this strategy with its exclusive rights to Warner Bros. theatrical releases.

For now, it’s likely that New Paramount will keep the template in place – but jettison brands such as BET that the company has already been shopping around. Watch for the axe to fall across the board.

In addition, Ellison may lean into Skydance Media’s partnership with the NFL. Currently, Skydance and the NFL have a strategic partnership through their joint venture, Skydance Sports. This partnership aims to develop and produce a wide range of sports-related content, including documentaries, scripted series, and unscripted shows.

The NFL is one of the most powerful brands on earth. The venture has already produced results, including documentaries such as NFL Draft: The Pick Is in for The Roku Channel and Kelce for Prime Video, which broke records on the streaming platform.

The Rise of a New Hollywood Mogul?

David Ellison is more than just Larry Ellison’s son. He has carved out his own path in the entertainment industry, producing a series of high-grossing films through Skydance. His portfolio includes hits like Top Gun: Maverick, the Star Trek movies, True Grit, and World War Z. Ellison has a keen sense of what audiences want, and he has consistently delivered crowd-pleasing entertainment.

Skydance’s success extends beyond the film industry. Skydance Television, launched in 2013, has also produced several popular and acclaimed series, such as Grace and Frankie, Altered Carbon, Tom Clancy’s Jack Ryan, and Reacher. Additionally, Skydance Interactive has established itself as a notable player in the gaming industry. This expansion into different entertainment mediums shows Ellison’s strategic vision and his commitment to creating content that resonates with diverse audiences.

Ellison does something else that is essential to succeeding in New Hollywood: forge successful partnerships, as seen in deals between Skydance, Apple TV+, and the one with the NFL cited above. Skydance has a multi-year deal with Apple TV+ to produce and distribute original films and television series exclusively on the platform.

This partnership has already resulted in the release of several projects, including The Greatest Beer Run Ever, Ghosted, and The Family Plan. The deal allows Skydance to rely on Apple's global reach and technological capabilities while providing Apple TV+ with original content.

One of Ellison’s biggest opportunities and challenges is figuring out the best way to distribute movies in theaters and online. Hollywood studios have been grappling with determining the optimal release window for new movies in theaters before transitioning them to streaming platforms. The COVID-19 pandemic accelerated experimentation with various models, including simultaneous releases and shorter theatrical windows.

Paramount, for instance, has found some success with shorter theatrical windows followed by streaming on Paramount+, balancing initial box office revenue with streaming growth – an example being the successful release of A Quiet Place Part II. Initially set for a traditional theatrical release, the movie’s debut was postponed due to the COVID-19 pandemic. Paramount decided to shorten the theatrical window to 45 days before making it available on Paramount+.

This approach allowed A Quiet Place Part II to perform well at the box office, grossing over $297 million worldwide, a strong showing for a film released during the pandemic. After its successful theatrical run, the movie’s availability on Paramount+ helped drive subscriptions and retain audience interest in the platform. This balanced strategy demonstrated Paramount’s ability to adapt to the evolving media landscape, applying both theatrical and streaming revenue streams effectively.

On the other hand, competitors have not always succeeded. Disney’s hybrid model of simultaneous releases on Disney+ and theaters has boosted subscriptions but faced legal and financial challenges. Warner Bros.’ day-and-date release strategy on HBO Max faced backlash and was ultimately adjusted to return to exclusive theatrical windows.

Meanwhile, Amazon and Netflix continue to use their platforms with limited or bypassed theatrical releases, focusing on driving subscriptions over box office earnings. Netflix, in particular, has a spotty track record experimenting with a windowing strategy.

No one has mastered the distribution game. Ellison could outflank his competitors in a very big way.

Ellison’s reputation as a hands-on producer who understands both creatives and audiences has earned him support from several influential figures in the industry. Creatives like Tyler Perry, John Krasinski, James Cameron, and Mark Wahlberg have voiced their support for the merger, believing in Ellison’s vision and leadership. This is especially noteworthy because Ellison has already said that New Paramount will lean into AI to create content.

Despite his impressive resume, Ellison faces significant challenges. Transforming Paramount into a New Hollywood powerhouse requires not just producing hit films but also redefining the company’s culture and business model. Ellison must navigate the complexities of the merger, integrate diverse corporate cultures, and manage the expectations of both investors and creatives. His success will depend on his ability to balance these competing interests and deliver a unified vision for New Paramount.

Will New Paramount Succeed?

While the merger presents significant opportunities, there are also substantial risks. The entertainment industry is highly competitive, and the landscape is rapidly evolving. New Paramount must differentiate itself from established players like Netflix and Disney+ while navigating the challenges of integrating two large companies.

For now, David Ellison knows he needs to focus on improving operations. But eventually, he must articulate a compelling longer-term entertainment strategy that will attract and keep subscribers, which is crucial to building an ad-tech business. Fortunately, New Paramount has a strong library of entertainment upon which to build a New Hollywood brand.